ASTORIA PLACE OF CAMBRIDGE

Within standard 12-15 month inspection cycle. Federal law requires annual inspections.

Astoria Place of Cambridge receives a Trust Grade of F, indicating significant concerns about the quality of care provided. They rank #830 out of 913 nursing homes in Ohio, placing them in the bottom half of facilities statewide and #3 out of 3 in Guernsey County, meaning only one local option is better. The facility is worsening, with issues increasing from 5 in 2023 to 11 in 2024. Staffing is a strength, earning a rating of 4 out of 5, and with a turnover rate of 0%, staff stability is excellent. However, they face concerning financial issues, with fines totaling $194,587, higher than 98% of Ohio facilities, and critical incidents have been reported, such as failing to ensure timely payment of bills and inadequate staffing in the kitchen, which could disrupt meal service for residents.

- Trust Score

- F

- In Ohio

- #830/913

- Safety Record

- High Risk

- Inspections

- Getting Worse

- Staff Stability ○ Average

- Turnover data not reported for this facility.

- Penalties ⚠ Watch

- $194,587 in fines. Higher than 79% of Ohio facilities, suggesting repeated compliance issues.

- Skilled Nurses ✓ Good

- Each resident gets 104 minutes of Registered Nurse (RN) attention daily — more than 97% of Ohio nursing homes. RNs are the most trained staff who catch health problems before they become serious.

- Violations ⚠ Watch

- 37 deficiencies on record. Higher than average. Multiple issues found across inspections.

The Good

-

4-Star Staffing Rating · Above-average nurse staffing levels

-

Full Sprinkler Coverage · Fire safety systems throughout facility

-

No fines on record

Facility shows strength in staffing levels, fire safety.

The Bad

Below Ohio average (3.2)

Significant quality concerns identified by CMS

Well above median ($33,413)

Significant penalties indicating serious issues

The Ugly 37 deficiencies on record

Aug 2024

3 deficiencies

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

PASARR Coordination

(Tag F0644)

Could have caused harm · This affected 1 resident

Based on medical record review and staff interview, the facility failed to ensure resident Preadmission Screening and Resident Review was resubmitted following a new mental health diagnosis added for ...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0676

(Tag F0676)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, observation, and interviews the facility failed to ensure therapy recommendation were implemented. This ...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0925

(Tag F0925)

Could have caused harm · This affected 1 resident

Based on observation and interview the facility failed to ensure the facility was free of pest. This affected two residents (#7 and #9) of 16 residents observed.

Findings included:

Observation on 08/...

Read full inspector narrative →

Mar 2024

1 deficiency

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0802

(Tag F0802)

Could have caused harm · This affected most or all residents

Based on observation, dietary staffing and schedule review and staff interview, the facility failed to employ and maintain sufficient staffing in the kitchen to ensure resident meal service was provid...

Read full inspector narrative →

Mar 2024

3 deficiencies

1 IJ (1 facility-wide)

CRITICAL

(L)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Immediate Jeopardy (IJ) - the most serious Medicare violation

Free from Abuse/Neglect

(Tag F0600)

Someone could have died · This affected most or all residents

⚠️ Facility-wide issue

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, including review of the facility payroll records, review of facility billing/financial information, revi...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0837

(Tag F0837)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, facility policy review, facility assessment review, and interviews, the facility failed to ensure an eff...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0865

(Tag F0865)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, staff interview and policy review, the facility failed to ensure continuous evaluations were in place to...

Read full inspector narrative →

Jan 2024

4 deficiencies

CONCERN

(D)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0568

(Tag F0568)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, review of billing statements, and interviews, the facility failed to respond to Resident #29 guardian's ...

Read full inspector narrative →

CONCERN

(D)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0602

(Tag F0602)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, financial statements, interviews, and policy review the facility failed to ensure an overpayment of $4,2...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0837

(Tag F0837)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, facility policy review, facility assessment review, and interviews, the facility failed to ensure an eff...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0865

(Tag F0865)

Could have caused harm · This affected most or all residents

Based on record review, staff interview and policy review, the facility failed to ensure continuous evaluations were in place to verify financial obligations were met as planned to prevent a potential...

Read full inspector narrative →

Dec 2023

4 deficiencies

1 IJ (1 facility-wide)

CRITICAL

(L)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Immediate Jeopardy (IJ) - the most serious Medicare violation

Free from Abuse/Neglect

(Tag F0600)

Someone could have died · This affected most or all residents

⚠️ Facility-wide issue

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review including review of facility payroll records, review of facility billing/financial informati...

Read full inspector narrative →

CONCERN

(D)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0569

(Tag F0569)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, review of resident fund information, and interviews the facility failed to notify Resident #19 and/or th...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0837

(Tag F0837)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, facility policy review and interview, the facility failed to establish an effective governing body, lega...

Read full inspector narrative →

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Room Equipment

(Tag F0908)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review and interview, the facility failed to ensure functioning equipment was maintained in the kit...

Read full inspector narrative →

Aug 2023

1 deficiency

CONCERN

(F)

📢 Someone Reported This

A family member, employee, or ombudsman was alarmed enough to file a formal complaint

Potential for Harm - no one hurt, but risky conditions existed

Food Safety

(Tag F0812)

Could have caused harm · This affected most or all residents

Based on observation and interview, the facility failed to ensure the kitchen grill hood, stove, and floor were clean and free of grease build up. This had the potential to affect all 24 residents. Fa...

Read full inspector narrative →

Jul 2022

5 deficiencies

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0567

(Tag F0567)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review and interview the facility failed to ensure Resident #8 and Resident #15's personal funds were deposited ...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Notification of Changes

(Tag F0580)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, facility policy and procedure review and interview the facility failed to ensure communication/notificat...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Medication Errors

(Tag F0758)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review and interview the facility failed to ensure the justified use of a psychoactive medication for Resident #...

Read full inspector narrative →

CONCERN

(E)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0582

(Tag F0582)

Could have caused harm · This affected multiple residents

Based on record review and interview the facility failed to ensure information contained on Notice of Medicare Provider Non-Coverage forms issued to Resident #15, #19, #26 and #330 was accurate. This ...

Read full inspector narrative →

CONCERN

(F)

Potential for Harm - no one hurt, but risky conditions existed

Menu Adequacy

(Tag F0803)

Could have caused harm · This affected most or all residents

Based on observation, record review, facility policy and procedure review and interview the facility failed to ensure meals were prepared and served as per the planned menu. This affected all 26 resid...

Read full inspector narrative →

Oct 2019

16 deficiencies

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0558

(Tag F0558)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review and interview the facility failed to provide reasonable accommodations during meals and acti...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Notification of Changes

(Tag F0580)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review and interview the facility failed to ensure Resident #20's physician was notified timely of a change in c...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0582

(Tag F0582)

Could have caused harm · This affected 1 resident

Based on record review and interview the facility failed to issue proper and complete liability notices once Medicare Part A services ended for residents who remained in the facility. This affected tw...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0583

(Tag F0583)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, medical record review, policy review and interview the facility failed to maintain resident confidentialit...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Safe Environment

(Tag F0584)

Could have caused harm · This affected 1 resident

Based on observation and interview the facility failed to provide a safe, clean, comfortable and homelike environment for all residents. This affected three residents (#3, #5 and #21) of 31 residents ...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Assessment Accuracy

(Tag F0641)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on medical record review and interview the facility failed to ensure comprehensive Minimum Data Set (MDS) 3.0 assessments ...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

PASARR Coordination

(Tag F0644)

Could have caused harm · This affected 1 resident

Based on record review and interview the facility failed to ensure Resident #8, who had indicators of serious mental illness had a pre-admission screening and resident review (PASARR) completed to det...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0646

(Tag F0646)

Could have caused harm · This affected 1 resident

Based on record review and interview the facility failed to ensure Resident #26, who had indicators of serious mental illness had a pre-admission screening and resident review (PASARR) completed to de...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Quality of Care

(Tag F0684)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review and interview the facility failed to ensure adequate and necessary services were provided fo...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0692

(Tag F0692)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review and interview the facility failed to ensure Resident #20 received nutritional supplements an...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0698

(Tag F0698)

Could have caused harm · This affected 1 resident

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review and interview the facility failed to ensure the implementation of ongoing coordination of care for Reside...

Read full inspector narrative →

CONCERN

(D)

Potential for Harm - no one hurt, but risky conditions existed

Infection Control

(Tag F0880)

Could have caused harm · This affected 1 resident

Based on observation, medical record review, policy review and interview the facility failed to ensure glucometer strips were disposed of properly after use. This affected one resident (#23) of one re...

Read full inspector narrative →

CONCERN

(F)

Potential for Harm - no one hurt, but risky conditions existed

Pharmacy Services

(Tag F0755)

Could have caused harm · This affected most or all residents

Based on observation, record review and interview the facility failed to implement effective pharmaceutical procedures to ensure the proper accounting of narcotic (controlled substance) medications. T...

Read full inspector narrative →

CONCERN

(F)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0761

(Tag F0761)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on observation, record review and interview the facility failed to ensure all medications, including narcotics were stored...

Read full inspector narrative →

CONCERN

(F)

Potential for Harm - no one hurt, but risky conditions existed

Antibiotic Stewardship

(Tag F0881)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** Based on record review, review of the antibiotic stewardship log, policy review and interview the facility failed to implement a...

Read full inspector narrative →

CONCERN

(F)

Potential for Harm - no one hurt, but risky conditions existed

Deficiency F0925

(Tag F0925)

Could have caused harm · This affected most or all residents

**NOTE- TERMS IN BRACKETS HAVE BEEN EDITED TO PROTECT CONFIDENTIALITY** 2. On 10/09/19 at 5:15 P.M. observation of the supper meal for Resident #33 revealed the resident repeatedly was swatting a fly ...

Read full inspector narrative →

Understanding Severity Codes (click to expand)

Questions to Ask on Your Visit

- "What changes have you made since the serious inspection findings?"

- "Can I speak with families of current residents?"

- "What's your RN coverage like on weekends and overnight?"

Our Honest Assessment

- • Licensed and certified facility. Meets minimum state requirements.

- • Multiple safety concerns identified: 2 life-threatening violation(s), $194,587 in fines, Payment denial on record. Review inspection reports carefully.

- • 37 deficiencies on record, including 2 critical (life-threatening) violations. These warrant careful review before choosing this facility.

- • $194,587 in fines. Extremely high, among the most fined facilities in Ohio. Major compliance failures.

- • Grade F (1/100). Below average facility with significant concerns.

About This Facility

What is Astoria Place Of Cambridge's CMS Rating?

CMS assigns ASTORIA PLACE OF CAMBRIDGE an overall rating of 1 out of 5 stars, which is considered much below average nationally. Within Ohio, this rating places the facility higher than 0% of the state's 100 nursing homes. A rating at this level reflects concerns identified through health inspections, staffing assessments, or quality measures that families should carefully consider.

How is Astoria Place Of Cambridge Staffed?

CMS rates ASTORIA PLACE OF CAMBRIDGE's staffing level at 4 out of 5 stars, which is above average compared to other nursing homes.

What Have Inspectors Found at Astoria Place Of Cambridge?

State health inspectors documented 37 deficiencies at ASTORIA PLACE OF CAMBRIDGE during 2019 to 2024. These included: 2 Immediate Jeopardy (the most serious level, indicating potential for serious harm or death) and 35 with potential for harm. Immediate Jeopardy findings are rare and represent the most serious regulatory concerns. They require immediate corrective action.

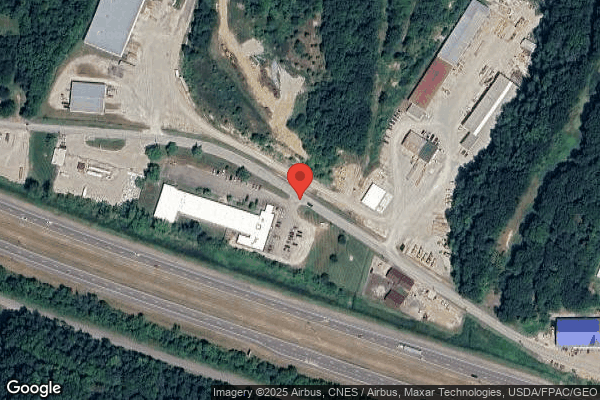

Who Owns and Operates Astoria Place Of Cambridge?

ASTORIA PLACE OF CAMBRIDGE is owned by a for-profit company. For-profit facilities operate as businesses with obligations to shareholders or private owners. The facility operates independently rather than as part of a larger chain. With 78 certified beds and approximately 29 residents (about 37% occupancy), it is a smaller facility located in CAMBRIDGE, Ohio.

How Does Astoria Place Of Cambridge Compare to Other Ohio Nursing Homes?

Compared to the 100 nursing homes in Ohio, ASTORIA PLACE OF CAMBRIDGE's overall rating (1 stars) is below the state average of 3.2 and health inspection rating (1 stars) is much below the national benchmark.

What Should Families Ask When Visiting Astoria Place Of Cambridge?

Based on this facility's data, families visiting should ask: "What changes have been made since the serious inspection findings, and how are you preventing similar issues?" "Can I visit during a mealtime to observe dining assistance and food quality?" "How do you handle medical emergencies, and what is your hospital transfer rate?" "Can I speak with family members of current residents about their experience?" These questions are particularly relevant given the facility's Immediate Jeopardy citations.

Is Astoria Place Of Cambridge Safe?

Based on CMS inspection data, ASTORIA PLACE OF CAMBRIDGE has documented safety concerns. Inspectors have issued 2 Immediate Jeopardy citations (the most serious violation level indicating risk of serious injury or death). The facility has a 1-star overall rating and ranks #100 of 100 nursing homes in Ohio. Families considering this facility should ask detailed questions about what corrective actions have been taken since these incidents.

Do Nurses at Astoria Place Of Cambridge Stick Around?

ASTORIA PLACE OF CAMBRIDGE has not reported staff turnover data to CMS. Staff turnover matters because consistent caregivers learn residents' individual needs, medications, and preferences. When staff frequently change, this institutional knowledge is lost. Families should ask the facility directly about their staff retention rates and average employee tenure.

Was Astoria Place Of Cambridge Ever Fined?

ASTORIA PLACE OF CAMBRIDGE has been fined $194,587 across 2 penalty actions. This is 5.6x the Ohio average of $35,025. Fines at this level are uncommon and typically indicate a pattern of serious deficiencies, repeated violations, or failure to correct problems promptly. CMS reserves penalties of this magnitude for facilities that pose significant, documented risk to resident health or safety. Families should request specific documentation of what issues led to these fines and what systemic changes have been implemented.

Is Astoria Place Of Cambridge on Any Federal Watch List?

ASTORIA PLACE OF CAMBRIDGE is not on any federal watch list. The most significant is the Special Focus Facility (SFF) program, which identifies the bottom 1% of nursing homes nationally based on persistent, serious quality problems. Not being on this list means the facility has avoided the pattern of deficiencies that triggers enhanced federal oversight. This is a positive indicator, though families should still review the facility's inspection history directly.